Founded in 2012, DelphX is a technology and financial services company

DelphX is a technology and financial services company focused on bringing new and exciting alternatives to structured product and credit markets.

Delphx Explainer Video

Where innovation meets investment security.

Recent Media Updates

DelphX Expands Wholly-Owned Broker Dealer Operations Through Addition of Internal Sales Team

DelphX Capital Markets Inc. (TSXV: DELX) (OTCQB: DPXCF) (“DelphX”), a leader in the development of new classes of structured products for the fixed income market, is adding a new vertical to its business operations (beginning in January 2024) through the creation of...

DelphX Announces Closing of Non-Brokered Unit Financing

Toronto, Ontario--(Newsfile Corp. - November 1, 2023) - DelphX Capital Markets Inc. (TSXV: DELX) (OTCQB: DPXCF) ("DelphX"), a leader in the development of new classes of structured products for the fixed income market, is pleased to announce that it has...

DelphX Provides Operational Update for Industry-First CRS Product; Launch Terms in Final Stage

DelphX Capital Markets Inc. (TSXV: DELX) (OTCQB: DPXCF) (“DelphX”), a leader in the development of new classes of structured products for the fixed income market, is providing an operational update in advance of significant launch-related milestones scheduled for the...

DelphX Sets Launch Schedule for Industry-First CRS Product; Improves Operational Depth with Addition of New CFO and Corporate Advisor

DelphX Capital Markets Inc. (TSXV: DELX) (OTCQB: DPXCF) (“DelphX”), a leader in the development of new classes of structured products for the fixed income market, is providing an operational update in advance of significant launch-related milestones scheduled for the...

DelphX Announces Warrant Extension

DelphX Capital Markets Inc. (TSXV: DELX) (OTCQB: DPXCF) (“DelphX”), a leader in the development of new classes of structured products for the fixed income market, announces that it intends to seek approval of the TSX Venture Exchange to extend the exercise...

Radius Research Webinar

https://www.youtube.com/watch?v=XfStHHY9W8g CEO Patrick Wood discusses the launch of new credit and risk products and their growth potential DelphX is a technology and financial services company focused on developing and distributing the next generation of structured...

View the Whitepaper on Credit Rating Securities

Focused on bringing new and exciting alternatives to structured product and credit markets

Through its special purpose vehicle Quantem, DelphX enables fixed-income dealers to offer new private placement securities that optimally transfer and diffuse credit risk, while allowing the enhancement of yield.

Market Cap January, 2024

LISTED SHARES OUT

Total Addressable Market

Upgrading the world's credit markets

DelphX provides Dealers with the ability to provide their client with a new product solution for either reducing credit exposure or enhancing yield.

Creating the Next Generation of Credit Products and Technologies

Massive Transformative Purpose

DelphX is committed to transforming credit markets by increasing access to efficient, transparent and cost effective hedging strategies and increased yields with no counterparty risks:

Provides a standardized facility to issue recognized and transparent securities fully collateralized by US Treasuries, eliminating counterparty risk.

Provides an additional vehicle for yield enhancement with improved underlying risk profiles at lower costs of capitalization – without increasing derivatives exposure.

Expanding access to those who do not participate in swaps and derivatives,

while also giving existing participants who are seeking risk protection / peculation a cost-efficient alternative to CDS.

A novel and enhanced product that can be used in conjunction with existing credit products and strategies.

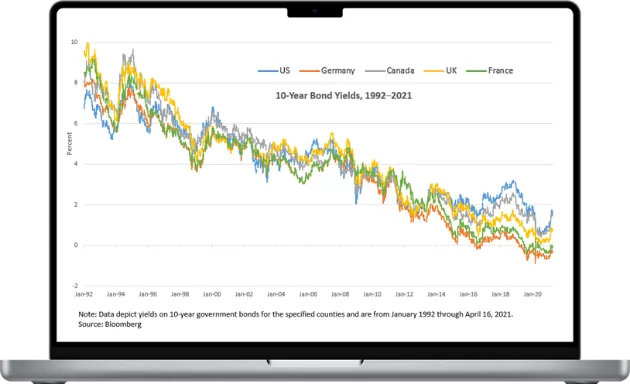

A Global Challenge

For over a decade, credit investors have endured a prolonged decline in investment yields. At the same time, the Credit Default Swap (CDS) market has shrunk materially:

FROM OVER

$50 Trillion

TO UNDER

$5 Trillion

The environment has been particularly vexing for life insurers and pension funds holding liabilities that were priced using assumed investment returns that are higher than can be currently achieved

THIS NEED FOR HIGHER YIELD HAS, IN TURN, CAUSED MANY CREDIT INVESTORS TO ASSUME GREATER LOSS EXPOSURE – RESULTING IN INCREASINGLY HAZARDOUS RISK/YIELD RATIOS.