Founded in 2012, DCM is a fixed income focused, placements company

DCM is a financial services company focused on bringing new and exciting alternatives to structured product and credit markets.

Recent Media Updates

DelphX Announces Delay in Filing Financial Statements

Toronto, Ontario, Apr 27, 2020 (Newsfile Corp via COMTEX) -- Toronto, Ontario--(Newsfile Corp. - April 27, 2020) - DelphX Capital Markets Inc. (TSXV: DELX) ("DelphX") announced today that it will rely on the relief provided by Ontario Instrument 51-502 Temporary...

DelphX Closes Previously Announced Unit Financing

Toronto, Ontario, Apr 24, 2020 (Newsfile Corp via COMTEX) -- Toronto, Ontario--(Newsfile Corp. - April 24, 2020) - DelphX Capital Markets Inc. (TSXV: DELX) ("DelphX") announces that it has closed its previously announced (see press releases dated March...

DelphX Announces Amended Pricing to Its Unit Financing

Toronto, Ontario, Mar 23, 2020 (Newsfile Corp via COMTEX) -- Toronto, Ontario--(Newsfile Corp. - March 23, 2020) - DelphX Capital Markets Inc. (TSXV: DELX) ("DelphX") announced today that it has amended the price of its previously announced unit financing (the...

DelphX Announces Non-Brokered, Unit Financing

TORONTO, March 12, 2020 /CNW/ - DelphX Capital Markets Inc. (TSXV: DELX) ("DelphX") announced today that it intends to proceed with a non-brokered private placement (the "Offering") of up to 10,000,000 units (the "Units") at a subscription price of C$0.05 per Unit,...

DelphX Announces the Issuance of Options

TORONTO, Dec. 10, 2019 /CNW/ - DelphX Capital Markets Inc. (TSXV: DELX) ("DelphX") announced that the Board of Directors has approved the grant of 1,150,000 stock options (the "Options") to an eligible participant under its stock option plan (the "Plan"). The options...

DelphX Closes Previously Announced Unit and Debenture Financings

TORONTO, Sept. 4, 2019 - DelphX Capital Markets Inc. (TSXV: DELX) ("DelphX") announces that it has closed both a non-brokered unit private placement (press release dated May 3, 2019) (the "Unit Financing") and a non-brokered secured, convertible debenture private...

Company Presentation on Credit Rating Securities

Delivering Alternative Credit Solutions for a Modern Market

DelphX Capital Markets is redefining access to structured credit and private capital. Through its special purpose vehicle, Quantem, DelphX enables fixed-income dealers and institutional investors to participate in innovative private placement securities that efficiently transfer credit risk and enhance yield — a long-overlooked gap in traditional markets.

With the launch of its broker-dealer subsidiary, DelphX Services Corp., the company now also facilitates private placements for high-potential mid-market companies, connecting them directly with hedge funds, institutional buyers, and family offices seeking differentiated deal flow.

Whether helping investors manage exposure or helping companies raise growth capital, DelphX is delivering the next evolution of credit market solutions

.

Market Cap January, 2024

LISTED SHARES OUT

Total Addressable Market

Transforming Credit Markets & Unlocking Mid-Market Capital

DCM empowers dealers with innovative tools to manage credit risk through CRS, while enabling private placements for growing mid-market companies—bridging capital with opportunity.

DCM is transforming credit risk management with Credit Rating Securities (CRS)—a first-of-its-kind solution designed to protect institutional investors from the impact of rating downgrades.

As a pioneer in structured credit innovation, we’ve developed a new class of fixed-payout instruments that deliver transparency, fast settlement, and seamless integration into existing portfolios—without counterparty risk. Our platform enables portfolio managers to manage capital charge risks more efficiently while unlocking new return opportunities through CRS and Collateralized Reference Notes (CRNs).

In addition to our credit risk transfer products, our broker-dealer subsidiary, DelphX Services Corp., provides access to private placements for mid-market companies—connecting institutional investors with differentiated deal flow and capital opportunities across North America.

Massive Transformative Purpose

Building a first of its kind product that allows transparent arbitrage of risk / price, allows counterparties transparency on underlying collateral, and democratizes a hedge that previously was only available to a narrow group of investors.

DCM is committed to transforming credit markets by increasing access to efficient, transparent and cost effective hedging strategies and increased yields with no counterparty risks:

Provides a standardized facility to issue recognized and transparent securities fully collateralized by US Treasuries, eliminating counterparty risk.

Provides an additional vehicle for yield enhancement with improved underlying risk profiles at lower costs of capitalization – without increasing derivatives exposure.

Expanding access to those who do not participate in swaps and derivatives,

while also giving existing participants who are seeking risk protection / peculation a cost-efficient alternative to CDS.

A novel and enhanced product that can be used in conjunction with existing credit products and strategies.

A Broken Market Demands Better Tools

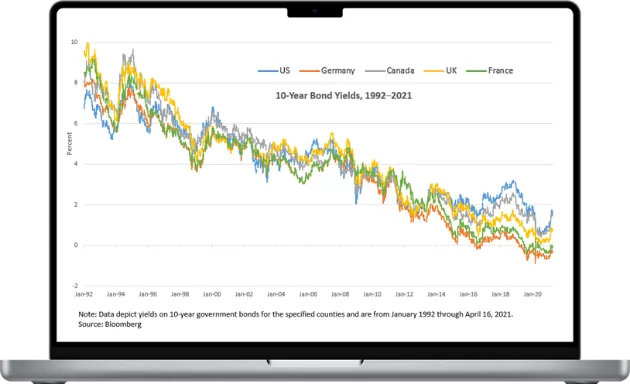

For over a decade, credit investors have faced shrinking yields and limited tools to manage risk. The collapse of the Credit Default Swap (CDS) market—from over $50 trillion to under $5 trillion—has left a massive gap in credit risk transfer.

At the same time, mid-market companies continue to struggle to access capital, despite rising investor demand for alternative yield opportunities.

DelphX addresses both challenges—delivering structured credit solutions that manage downgrade risk and offering private placement services that unlock institutional capital for growth-stage companies.

FROM OVER

$50 Trillion

TO UNDER

$5 Trillion

The current environment is especially difficult for insurers, pension funds, and income-seeking investors—many are holding liabilities priced with return assumptions no longer achievable. And for mid-sized issuers, traditional capital markets remain out of reach.